How to plan your dream vacation on a tight budget?

Forensic accountants and their role in determining financial fraud

Introduction

There is no doubt that when you are running a business, you have to look at the financial integrity and the risk associated to this. But you don’t need to worry because now there are very good and easy solutions for this. You can manage your financial risks well by consulting good financial accountants.

However, according to a study, 63% of financial frauds occur annually, which is very worrying. But these advisors can save you from all these risks based on their research and study. So in today’s blog, we will look at what forensic accountants are? What is financial fraud? And how also detect it.

What forensic accountants are?

Forensic accountants are qualified experts who utilize their accounting knowledge to analyze financial activities. They carefully examine documents, seeking evidence of fraud or misbehavior. Furthermore, they follow the money trail, gathering evidence to reveal criminal actions including stealing and money laundering.

Hence, their efforts are critical in assisting law enforcement authorities and legal teams in constructing solid cases against people or organizations implicated in financial crimes. Forensic accountants play an important role in maintaining the integrity of financial systems and serving justice by delving deeply into financial records and giving transparent evidence.

What is Financial Fraud?

In fact, financial fraud occurs when a person knowingly misrepresents the truth of something in order to unfairly obtain money or prevent repayment of a loan. This can be done in various ways such as exaggerating a company’s performance, committing fraud.

Tricking people into investing where they are not present, or using someone else’s credit card without the owner’s knowledge. This is not only illegal but also a very dangerous practice as the people affected by it will be in great trouble.

Which types of financial frauds are common?

When it comes to the types of financial fraud, there are many frauds that are common in the society now. Here are some most common:

Expense frauds

Often, people or companies overstate their actual expenses, thereby engaging in expense fraud. Or we can say a claim for compensation which was not actually incurred. Therefore, it is better to have clear expenditure policies and procedures.

This can be done through the implementation of technologies that provide automatic reporting of expenses and also through regular audits.

Pyramid scheme frauds

This is the most common scam today in which a scheme promises huge profits to customers. Consequently, the investor invests in their product but, the interesting information is that they don’t actually own the product.

However, some schemes pretend to sell products but are actually hiding their pyramid structure. So if you are involved in this type of scheme you should cut it off immediately.

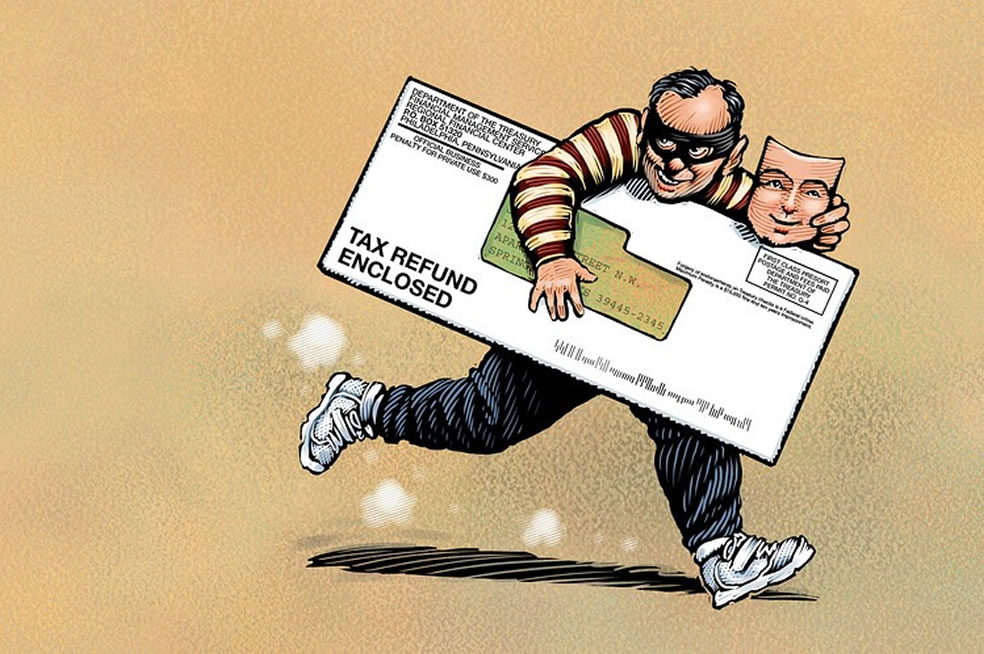

Tax refund fraud

In this type of fraud, fraudsters file tax returns in your name. Then, they add false income information to the report to maximize your refund and submit it. Another form of this scam is when you deal with a fraudulent tax advisor who takes your information or files a false return in your name.

Therefore, you should check your tax return carefully and if you receive a letter about tax return fraud, follow the instructions in the letter.

Identity frauds

Identity fraud occurs when someone else uses your personal information to steal money such as your CNIC number, your bank account number or credit card number without your permission. As a result, this may increase your stress level as well.

For this reason, it is recommended to never share your personal information with anyone so that you don’t become a victim.

Financial statement fraud

Financial statement fraud is the intentional alteration of financial statements to deceive a user’s personal information and provide a false picture of a company’s financial position, performance and cash flows.

Conclusion, make sure all your checks and cash are immediately documented and deposited as they were received.

How Do Forensic Accountants Deduct Fraud?

First, deduction of fraud by forensic accountants is being done with the help of various methods which are realized through prevention, detection and response procedures. Then, they prevent businesses from potential losses that may revolve around.

Identification is used with a variety of techniques including financial analysis methods, data forensics, and digital analysis to identify and detect unusual and suspicious financial activity that may indicate fraudulent behavior. After it is determined that fraud has occurred, forensic accountants attempt to investigate the matter and gather evidence, calculate damages, and, where necessary, litigate.

However, here is some common process through which they conduct research:

Data Analysis

Transaction Tracing

Internal Controls Evaluation

Interviews and Interrogations

Financial Ratio Analysis

Law Analysis

Digital Forensics

Expert Testimony

Documentation and Reporting

Their job is not only carrying out calculations and estimation but also keeping a continuous space for any cost arising from fraud events for instance, business interruption, property damage, or loss of inventory. In the end, after all, the frauds are solved only due to the applied investigative forensic accountant skill which makes the solution all the more successful and professional.

Final Words

Finally, forensic accountants serve as invaluable guardians of financial integrity, playing an important role in detecting and combating various forms of financial fraud. As fraudulent activity continues to proliferate, their expertise becomes increasingly important in protecting businesses and individuals from catastrophic financial losses.

Additionally, forensic accountants play an active role in preventing financial fraud by identifying weaknesses in the financial system, recommending stronger controls, and implementing safeguards. Their comprehensive approach to fraud detection and prevention not only reduces the immediate risks associated with fraudulent activities, but also promotes a culture of accountability and transparency within organizations.

Have Any Question?

We value your feedback, questions, and suggestions. Your input helps us improve our services.

- 020 7190 9690

- info@syonassociates.com